There is a Masai proverb that reads: “Even the ostrich, with its long neck and sharp eyes, cannot see what will happen in the future.” That uncertainty is vividly illustrated by the disagreement about this year’s economic growth between the International Monetary Fund (IMF) and the South African Reserve Bank (SARB).

On 20 July the SARB said: “The domestic growth outlook remains a concern, following the surprise broad-based GDP growth contraction during the first quarter of this year. With the exception of the primary sector, all sectors

recorded negative growth. While positive growth is expected in the second quarter, the Bank’s annual growth forecasts have been revised down further. The forecast for 2017 has been adjusted down from 1.0% to 0.5%.”

On 24 July the IMF said: “The slight upward revision to 2017 growth relative to the April 2017 World Economic Outlook forecast reflects a modest upgrading of growth prospects for South Africa, which is experiencing a bumper crop due to better rainfall and an increase in mining output prompted by a moderate rebound in commodity prices.” The IMF raised its growth forecast to 1.0% from 0.8% in April.

This uncertainty about future prospects was also reflected in the second quarter consumer confidence survey. The main driver of the fall in consumer confidence in the second quarter was a sharp reversal in consumers’ view on economic prospects. In the first quarter, consumers were fairly confident about future economic conditions due to the abundant rain in the summer rainfall area, a stronger rand and the consequent moderation in food inflation. However, consumers reversed their view on the prospects for the economy in the second quarter due to the late March cabinet reshuffle and consequent ratings downgrade to junk status. The economic outlook sub-index moved from -23 in the fourth quarter to -1 in the first quarter and then back down to -22 in the second quarter. Last week’s interest rate cut could easily see consumers change their mind again as they now have more money to spend as their debt burden has been reduced and food and fuel prices are easing.

Despite the fall in the economic outlook index, the index reflecting consumers’ view of their own finances improved due to the fall in food and energy costs. The index improved to +6 in the second quarter from +3 in the first quarter. The index measuring the appropriateness of the present time to buy durable goods, such as furniture, appliances and electronic equipment also improved to the best level since the third quarter 2015. It rose to -12 in the second quarter 2017 from -17 in the first quarter and we should see a further improvement in the third quarter. The improvement in new vehicle sales in June from a year ago may therefor reflect a recovery in consumer confidence going forward.

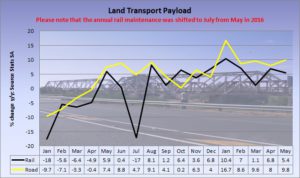

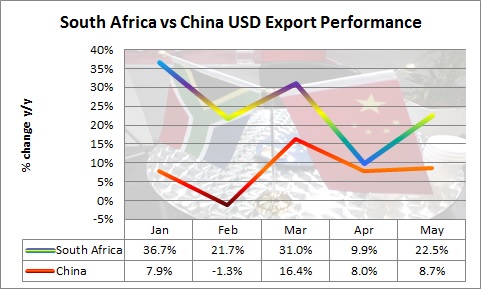

Unfortunately, the data for 2017 will only be released in March 2018 and it is only then that we can see who was more accurate. Based on the data for the first five months, the IMF seems to be better placed as land transport payloads and export revenue show an improving trend, but the second half could see the SARB proved correct.