By TUSANI MNYANDU

A local tax practitioner says taxpayers shouldn’t be lulled into leaving their assessments in the hands of SARS. This comes as the tax and customs collecting agency announced during a media briefing on 30 July 2020 addressed by Commissioner Edward Kieswetter.

Kieswetter was delighted at being able to open the tax season a month early. The tax season for individuals was originally gazetted to start on 1 September 2020. The tax-collecting agency recently announced it would start a month earlier, in August.

More than 62 300 tax returns have already been filed, of which 12% have been flagged for audit and 88% assessed. These returns were filed through a relatively new method, called Auto Assessment. This method was piloted in the 2019 individuals filing season, for taxpayers with a taxable income of less than R500 000.

What is the auto assessment?

Auto assessment is a method of filing a return, by which SARS collects information from third parties, such as your employer, banks, medical aid provider, and pension funds among others. SARS collates this information and prepares a return.

It then calculates the outcome (the assessment) for the taxpayer, which indicates whether a refund is due to the taxpayer or if money is due to SARS.

All that the taxpayer has to do is to accept that assessment that was done automatically by the system and their tax return will be filed. This acceptance can be done within three seconds, according to SARS. The automatic assessment does not absolve the taxpayer from the responsibility of ensuring that the return that is filed is accurate, however.

How does it work?

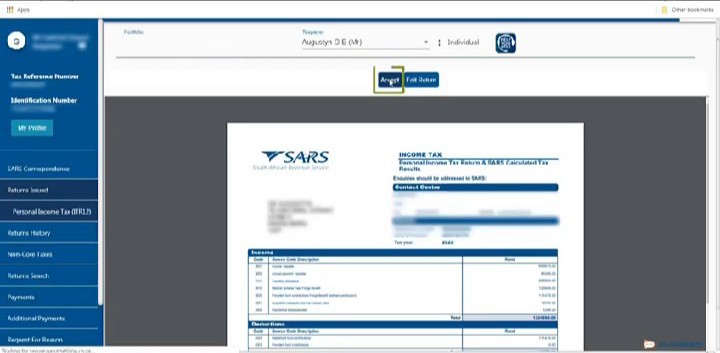

Once a return has been prepared, SARS sends an SMS to taxpayers, to the cellphone number registered with them. This tells the taxpayer that they have been auto assessed and indicates the outcome of that auto assessment. The SMS contains a link to the taxpayer’s e-filing profile, which can be opened on SARS e-filing (the web) or the SARS MobiApp (Mobile app available on and iOS).

Once the profile is opened in either of the platforms, the taxpayer can view the information contained in the return.

If you agree with the information, you can press “Accept” and the return will be filed.

If you don’t agree with the information contained in the return, whether due to additional income that they wish to declare or additional tax-deductible expenses, or information affecting their tax credits such additional medical expenses, you have the option to “Edit” the return and add the relevant information.

Once you’ve added that information, you can file the return.

A negative figure in the SMS means that the taxpayer will receive a refund, while a positive figure indicates that the taxpayer owes SARS and must make arrangements to make payments.

SARS has committed to paying any returns that are due within 72 hours.

What if I do not receive the SMS or the third party information is wrong?

There are many reasons why you may not receive an SMS. One of them is that you changed the cellphone number that’s registered at SARS. Another reason could be that your return is complex and does not meet the criteria for auto assessment.

It is therefore important to ensure that all your information is updated at SARS.

It may happen that your employer has not filed your employee’s tax (Pay as You Earn) information with SARS.

This will mean that your experience will not be as smooth, with the auto assessment. The commissioner encouraged employees to hold their employers accountable by ensuring that they file in time and to furnish them with their IRP5 certificates. To date, 57% of employers have filed their returns and 20% of those employers submitted late.

To improve their experience, SARS encourages taxpayers to take care of information hygiene measures by:

- Ensuring that bank details are in order;

- Tax accounts are in order (outstanding returns filed and outstanding debts paid);

- Demographic information is accurate;

Taxpayers have, according to SARS, a window period of the month of August to resolve the data hygiene issues.

The tax collector plans to issue 3.1 million auto assessment SMSs to taxpayers in August.

Fake SMSs:

Criminal elements have been detected amid this drive by SARS. Speaking on television recently, the commissioner indicated that they had become aware of fake SMSs doing rounds. “We ask taxpayers to have a careful read at the SMS they receive,” Kieswetter said. He pointed taxpayers to the correct SARS website which is www.sars.gov.za

Important dates:

- 1 September 2020 to 22 October 2020 – Manual filing of tax returns. This can be done at SARS offices by appointment only and it is highly discouraged by SARS due to the dangers associated with Covid-19.

- 1 September 2020 to 16 November 2020 – Filing online via SARS e-filing or SARS MobiAPP.

Provisional taxpayers have up to 29January 2021 to file their returns.

Beefed up system:

Commissioner Kieswetter warned taxpayers that they have beefed up their system to detect non-compliance and that SARS will act even more decisively against any attempts of defrauding the system. Methods taxpayers were using to defraud the system included disability claims and dental losses, business losses, such as claiming rental losses against rental income and pay as you earn credits.

The move by SARS may not be as smooth sailing as anticipated, warns Candice Mullins, managing director at the Gramahstown–based consulting firm The Tax House.

“SARS eFiling is an independent entity and merely interfaces with the SARS ‘core’ and so the potential for errors occurring always remains a possibility,” Mullins noted in a newsletter sent to the firm’s clients. The firm advised its clients to not simply accept the SARS Auto Assessment but ensure that it is reviewed so that the correct refund or payment is calculated.

Grocott’s Mail tried to confirm with SARS spokesperson Siphithi Sibeko whether SARS will be dispatching its mobile tax units to smaller towns such as Makhanda under lockdown. No response had been received by the time of publication. This story will be updated as and when a response is received.

Taxpayers can contact SARS by calling their contact centre on 0800 007277 or visiting its website: www.sars.gov.za