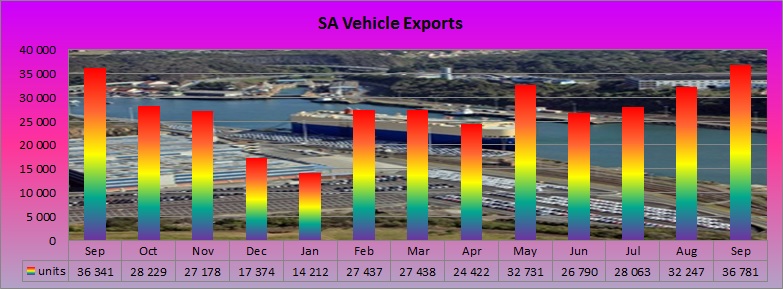

The National Association of Automobile Manufacturers of South Africa (NAAMSA)on Monday reported that new vehicle exports reached a new record high of 36 341 units, which was a 1.2% increase on the previous record set in September 2017 and 14% more than the August number and is good news for the South African economy, as it means that the rand could strengthen and reduce the cost of imported goods such as oil.

The 15% boost in vehicle unit exports compared with July was one of the reasons why the foreign trade balance swung to a R9.8 billion surplus in August from a R5.3bn deficit in July. The value of transport equipment export surged by R3.986bn in August to R16.482bn, so this export category could top R20bn in September and support the Eastern Cape economy where several motor manufacturers are located.

The Association said vehicle exports remained a function of the direction of the global economy which, despite rising protectionism and trade disputes, continued to reflect robust conditions.

“Following the record export sales during September, 2018 and taking into account relatively strong order books reported by most vehicle exporters, exports were expected to improve further and reflect strong upward momentum in 2019, 2020 and subsequent years. The projection of export sales for 2019 was currently 384 000 export units compared with an estimated figure of 340 000 for the current year,” the industry body said.

Last year there had been a disruption to vehicle exports due to storms along the eastern seaboard with the result that October 2017 exports dropped by 22% month-on-month and industry executives are keeping their fingers crossed that this year will not see a repeat.

New vehicle sales for September were down 1.9% year-on-year (y/y) with a total of 49 670. This was the fourth y/y decline so far after declines in January, February and August. Despite this, the year-to-date number was only marginally lower with a 0.8% y/y decline.

Looking specifically at the dealer channel that accounted for 79% of new vehicle sales in the industry, total unit sales were down 2.3% y/y. Nevertheless total new vehicle sales through the dealer channel have remained relatively strong, showing an increase of 1.9% year-to-date.

Consumers have had their disposable income impacted by price increases from manufacturers due to the weakening rand, the hike in the Value-Added Tax rate to 15% from 14% implemented in April and ongoing fuel price increases that have resulted in a record October retail petrol price in Gauteng of R17.08 per litre, which is 21.9% more than a year ago.

Rentals sales increased significantly in September at 20% y/y, but were still down 3.6% on a year-to-date as tourism growth in the first seven months of this year has been subdued. Part of President Cyril Ramaphosa’s stimulus plan announced last month was to ease visa requirements to boost tourism, which is a key job creator.

“The increase in rental sales is a seasonal trend seen this time of year as rental companies gear up for the pending holiday season,” said John Loxton, WesBank Executive Head of Fleet Management and Leasing.

Sales of new light commercial vehicles, bakkies and mini buses dipped 1.2% y/y in September, while sales in the low volume medium and heavy truck segments of the industry reflected some improvement and grew by 0.4% and 4.7% respectively compared with the corresponding month last year.

Both segments had now recorded improvements for the third consecutive month indicating an improved confidence among businesses.