Although the South African economy entered a technical recession, defined as two consecutive quarters of contraction, in the second quarter, underlying figures suggest a more upbeat reading of growth.

The economy declined by 0.9% in the second quarter on a quarter-on-quarter (q/q) seasonally-adjusted annualised (saa) basis after a 2.6% contraction in the first quarter as measured from the expenditure side, but if one excludes the change in inventories, real final sales grew by 2.0% in the second quarter after a 3.1% drop in the first quarter.

Imagine the South African economy as a household.

You invite six guests for supper and accordingly prepare six meals, in other words you match supply with demand. Now if one of your guests brings along a partner, then you dip into the pantry and prepare another meal. In my view the more the merrier, but that is not how national accountants view changes in inventories. In their view if you dip into the pantry that subtracts from the economy. My view is reflected in final sales, their view in gross domestic product (GDP) data. You need to decide whether a dinner party of friends or a doom gathering of national accountants is the correct view.

Changes in inventories are important as they show how responsive domestic producers are to changes in demand.

The second quarter inventory drawdown was concentrated in the manufacturing and mining sectors, indicating that these sectors have not been sufficiently responsive to a surge in external demand as exports jumped by 13.7%, while imports only grew by 3.1%.

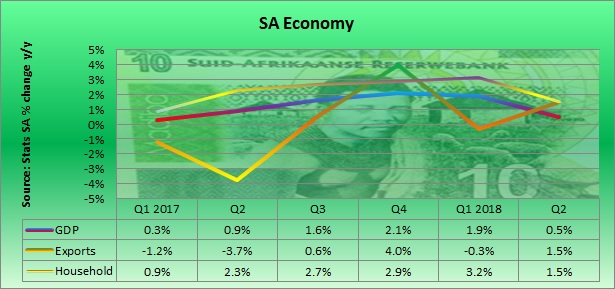

On a year-on-year (y/y) basis GDP growth eased to 0.5% in the second quarter due to the slowdown in domestic demand after growing by 1.9% in the first quarter as exports grew by 1.5% after a 0.3% decline in the first quarter. Household consumption expenditure slowed to 1.5% growth from a 3.2% increase in the first quarter. This resulted in GDP growth of 1.2% y/y in the first half with many economists expecting a better second half as above-inflation wage increases boost consumer demand.

Citadel Chief Economist Maarten Ackerman said that although the technical recession of two consecutive quarters of contraction heightened South Africa’s risk of suffering yet another credit downgrade in the second half of the year, he expected an upside surprise in the second half.

“The 1.5% growth estimated by National Treasury in February’s budget speech is currently at severe risk and will likely need to be revised downwards, creating a very difficult environment next month for the delivery of the Medium Term Budget Policy Statement,” he said.

He noted that if the drag from the agricultural industry were excluded from the figures, weak contributions from other industries would still see GDP growth at a mere 0.1% in the second quarter.

“Despite this, it is somewhat positive to see that the mining, construction, electricity and financial industries all contributed positively to the economy over the past quarter, as these industries form the growth engines of the economy and hold the most potential for job creation. If Cyril Ramaphosa and his government continue with the current policy strategy as well as provide clarity on mining and land, I believe that there might be a surprise to the upside coming from the low base,” he concluded.

The domestic demand side of the GDP equation pulled down growth as household final consumption expenditure declined for the first time since the first quarter 2016 with a 1.3% drop on a q/q saa basis in the second quarter, while government consumption expenditure only grew by 0.7%. Poor business confidence meant that gross fixed capital formation decreased by 0.5%.

Professor Raymond Parsons from the North West University Business School also highlighted the pockets of strength in his reaction statement.

“The extent to which the latest GDP figures for the second quarter confirm that the SA economy is in a ‘technical recession’ is bad news for business confidence and employment prospects. There are fortunately still several pockets of strength in the economy. But it is clear that SA has greatly underestimated the economic damage of the past decade, on how long it will realistically take to turn the economy around, and the negative impact of persistent levels of policy uncertainty, such as around issues like land reform. Boosting business and consumer confidence remains a major key if SA is to break out of the ‘low growth trap’ into which the recession has now pushed it,” he wrote.

Sanlam Investment Management economist Arthur Kamp warned that the expected recovery in the second half could be compromised by increasing protectionism, a point highlighted at this year’s BRICS Summit in Johannesburg.

“Looking ahead to the rest of 2018 and 2019, it seems reasonable to expect growth momentum to lift a little as the impact of the drought in the Western Cape fades, assuming the nascent shift towards global trade protectionism does not derail the global economic expansion. After all, momentum in the South African Reserve Bank’s leading indicator continues to point to a better second half of the year. But, that said, the tightening of global financial conditions imply countries running macroeconomic imbalances will be placed under closer scrutiny by investors, especially if imbalances reflect a weak fiscal position,” he wrote.