Continuing a series of lower than expected inflation outcomes, the June consumer inflation rate was 4.6% year-on-year (y/y) compared with the consensus forecast of a rise to 4.8% y/y. The lower than expected inflation rate eases the pressure on the South African Reserve Bank to hike interest rates to curb inflation.

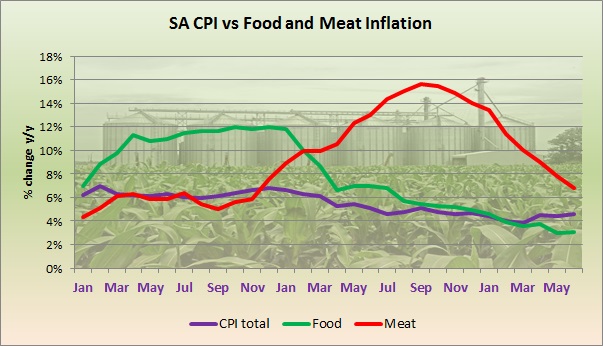

The March consumer inflation data surprised on the downside as most economists had expected the February data to be the low point in the current inflation trajectory, so the consensus forecast was for a rise to 4.1% y/y from February’s 4.0% y/y. Instead the inflation rate eased to 3.8% y/y in March as annual food inflation slipped to 3.6% in March from 3.9% in February and 12.0% in December 2016.

The consensus forecast for the April consumer inflation rate was a rise to 4.7% y/y, while the actual outcome was 4.5% y/y, and in May the consensus forecast was a rise to 4.6% y/y, while the actual outcome was 4.4% y/y.

The hike in the Value-Added Tax (VAT) rate to 15% from 14% on April 1, as well as a host of other increases in indirect taxes such as the sugar tax and fuel levy, pushed up Eastern Cape inflation to 4.5% y/y in April from 3.8% y/y in March, but there was an easing to 4.0% y/y in May before a rise to 4.3% y/y in June.

The annual average for the Eastern Cape was 5.3% in 2017 from 7.4% in 2016, while the national annual average rate was 5.3% in 2017 from 6.4% in 2016.

It was rich carnivores that kept inflation elevated in the second half of 2017 as meat inflation was in double-digit increase territory even though the rate moderated to 14.0% y/y in December from 14.9% y/y in November, 15.5% y/y in October and 15.6% y/y in September. The richer you are, the more meat you consume. Meat inflation is moderating in 2018 and eased to 6.8% y/y in June from 11.4% y/y in February.