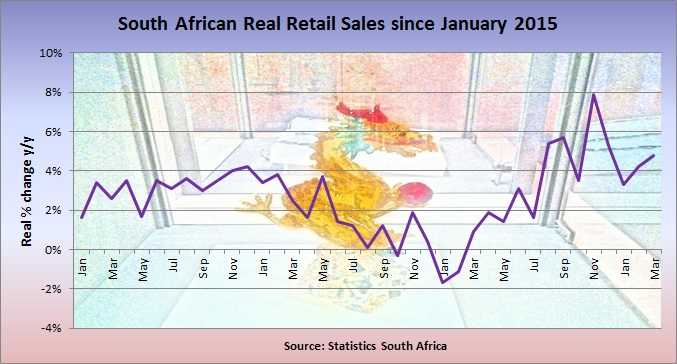

Real retail sales show quarterly contraction in first quarter

By Helmo Preuss

The first quarter 2018 showed a 5.2% seasonally adjusted annualised decline from the fourth quarter in real retail sales despite a 4.8% year-on-year (y/y) increase in March according to Statistics South Africa (Stats SA) data after a downwardly revised 4.2% (4.9%) y/y increase in February. The quarterly decrease was due to the strong sales in the fourth quarter 2017.

This means the South African economy is likely to have a quarterly contraction in the first quarter, as last week’s Stats SA data on manufacturing and mining production had quarterly contractions of 6.5% and 9.7% respectively. On a year ago basis, retail sales advanced by 4.1%, but manufacturing production grew by only 0.4%, while mining production declined by 1.8%.

This is one of the reasons why imports have increased by 9.1% y/y in the first quarter, while exports have grown by only 0.4% y/y, as South African manufacturers have been slow to react to the improved demand conditions. That meant that overseas suppliers had to step into the gap left by domestic producers. The April ports data show a waning in import demand as full containers imported fell by 0.9% y/y.

In the fourth quarter 2017 real retail sales grew by 5.5% y/y, yet manufacturing production only increased by 1.9% y/y. That is why the survey of purchasing managers in the manufacturing sector show a continued depletion of inventories, as the inventory sub-index has been below the neutral 50 level for more than a year in April 2018.

The good news is that manufacturers are aware of their need to gear up production to meet improved demand, so they added 58,000 jobs in the first quarter compared with the fourth quarter.

The question now is how will foreign investors react to the probable contraction in first quarter gross domestic product when the data is released on June 5? Last week saw the second largest weekly outflow in portfolio flows as foreigners sold a net R15 billion of bonds and a net R4.1 billion worth of equities. The record weekly outflow was in the week ended October 24 2008 when foreigners sold a net R20.9 billion worth of bonds and a net R4.2 billion worth of equities.