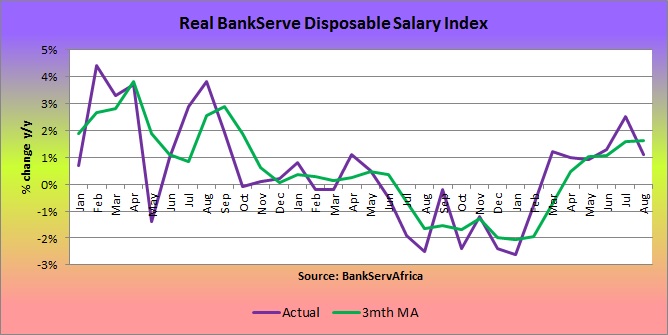

Real disposable income, in other words what you get to take home after tax, increased slightly for the sixth consecutive month in August on a year-on-year (y/y) basis according to data released by economists.co.za. They analyse the information of transfers via the South African payments system and create an index called the BankservAfrica Disposable Salary Index (BDSI).

The bottom line is that although the y/y increase slowed to 1.1% in August from 2.5% in July, this followed nine consecutive months last year when there were y/y declines, as take-home pay did not keep pace with inflation. As inflation recedes given the drop in fuel and food prices, so consumers will have more inflation-adjusted take-home money to spend on what they desire.

The improvement in real disposable income is already reflected in real retail sales data, which jumped to a 3.2% y/y increase in June from a recent bottom of a 1.7% y/y decline in January. As food prices are set to fall in coming months this should show up in rising income and consumer spending.

Already in the second quarter there was a substantial increase in the real consumption spending by households with a 4.7% quarter-on-quarter jump in seasonally adjusted annualised terms. On this basis, the main positive contributors to household spending growth were food and non-alcoholic beverages (10.1%), clothing and footwear (26.7%), and the ‘other’ category of expenditure (8.2%). This growth was on the back of a relatively low growth in real disposable income on a year ago basis, so there should be continued strong growth in this category in the third quarter given the acceleration in real disposable income so far in this quarter.