By Helmo Preuss

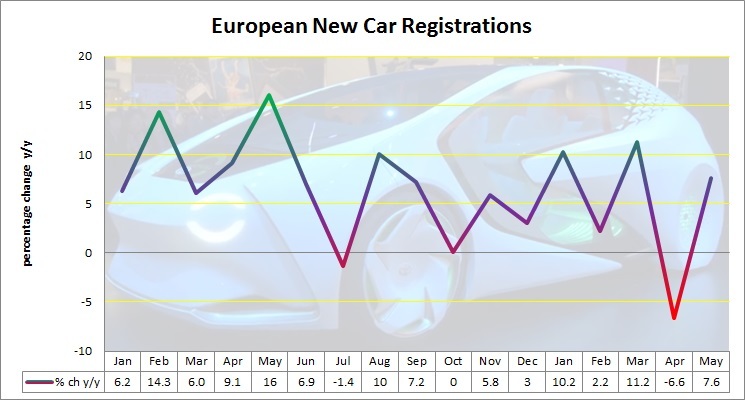

The European Union (EU) new car market saw registrations rise by 7.6% year on

year (y/y) in May to 1,386,818 units. In volume terms, this result comes close to

May 2007 levels, just before the economic crisis hit the European auto industry,

which bodes well for the platinum price.

This is because European demand accounts for just over a third of global

platinum demand for use in autocatalysts, even though the region produces less than

a quarter of worldwide new cars. This disparity is because the Europeans have

stringent emission standards that require higher platinum loadings in the

autocatalysts.

The essential part that platinum group metals (mostly platinum, palladium and

rhodium) play in cleaning up the environment is reflected in the fact that,

according to the European Automobile Manufacturers’ Association, one car in the

1970s produced as many pollutant emissions as 100 cars today.

This means that the average car engine emits 28 times less carbon monoxide

than 20 years ago with 71% of new cars in 2012 emitting less than 140g of carbon

dioxide per kilometre, with more than half of those emitting less than 120g. Pollutant

emissions from trucks have been slashed to near-zero levels and are now 98% less

than in 1990.

The rise in new car demand also helps South African motor manufacturers who

export to Europe. Motor manufacturers plan to export some 375,000 units this year

compared with 344,822 units last year.

The five big EU markets performed very well in May with the exception of the

United Kingdom (UK). Germany was the top performer with a 12.9% y/y jump, closely

followed by Spain (11.2%), France (8.9%) and Italy (8.2%). The UK market suffered a

8.5% y/y decline, as a weaker pound following last year’s Brexit vote made imports

more expensive.

In the first five months of 2017, demand for passenger cars grew by 5.3% y/y

throughout the EU to 6,719,209 units. Italy (8.1%), Spain (7.3%), Germany (4.7%)

and France (3.3%) all saw their markets grow, while the UK had small decline of

0.6%.