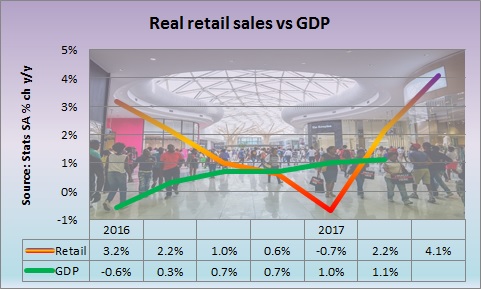

4.1% year on year jump in retail sales in Quarter 3

Consumers opened their purses in the third quarter with a 4.1% year-on-year (y/y) jump in retail sales after a 2.2% y/y gain in the second quarter and a 0.7% y/y drop in the first quarter following a 1.7% increase for the full year 2016 according to Statistics South Africa (Stats SA) data.

This retail surge is confirmed by the strong growth in new vehicle sales, which have increased on a year ago basis for the past five months. Grocott’s Mail readers have become accustomed to receiving bad news about the economy, particularly since December 2015, but this data shows that many households seem to be in better shape to weather economic storms than they were last year. The downgrade in economic growth by Treasury from 1.3% for this year made in the February Budget to only 0.7% in the October Medium Term Budget Policy Statement (MTBPS) may be overdone.

Economists generally have a poor forecasting record at turning points as it is human nature to project the present into the future, so the recession in the last quarter last year and first quarter this year may have tainted their forecasts. Credit bureau Transunion when commenting on the first quarter Consumer Credit Index (CCI) data already warned that households were better equipped this year than last year to handle adverse economic conditions, but that advice seems to have gone unheeded. The result is that many retailers are suffering “stock outs” as they do not have sufficient inventory to cope with a resurgent consumer.

This poor inventory situation was exacerbated by the October storms in KwaZulu-Natal that disrupted port operations at Durban. As Durban is the main entry point for imported consumer goods with full containers imported declining by 17.9% y/y.

In the latest Transunion report it noted that although consumer credit health dipped in the third quarter from the second quarter, it remained above the break-even 50 level. The Consumer Credit Index (CCI) eased to 53.9 in the third quarter from 54.1 in the second quarter and has been above 50 since last year.

The CCI is a measure of overall credit health among South African borrowers, based on data gathered from some 54 million accounts and a revolving credit value near R150 billion. A rating of 50 is considered the break-even point, with lower scores reflecting worsening credit health, which is characterised by an increase of new accounts in default (three months in arrears), as well as distressed borrowing (using one source of credit, say credit card, to pay off another such as school fees or car loans).

The central theme in this report is that household debt is growing at a slower pace than household income. South African Reserve Bank (SARB) data shows household debt as a proportion of disposable income is declining with the ratio easing to 72.6% in the second quarter 2017 from 73.0% in the first quarter 2017 and 83.0% in the first quarter 2010.

In addition to reducing debt, household cash flow improved slightly in the third quarter with a 0.4% year-on-year (y/y) gain after being virtually unchanged y/y in the second quarter. Transunion noted that real income is struggling to improve materially.

Household debt service costs declined by 5.2% y/y in the third quarter because of household deleveraging as well as a reduction in the prime lending rate due to the SARB repo rate cut in July. Accounts in early default, that is three months in arrears, fell by 3% y/y in the third quarter, while distressed borrowing declined by 1.4% y/y.

The report cited that a relatively stable rand has been an immense help in cushioning South Africa’s perceived instability among international investors, though it acknowledged that political uncertainty and sovereign credit rating downgrades were risks that needed to be watched closely in the coming quarters.